US Plastic Companies Calculator

Resin Manufacturers

Produce base plastic materials. ~250 companies.

Converters / Contract Manufacturers

Transform raw plastics into usable products. ~5,200 companies.

End-Product Manufacturers

Create finished plastic goods for consumers. ~7,750 companies.

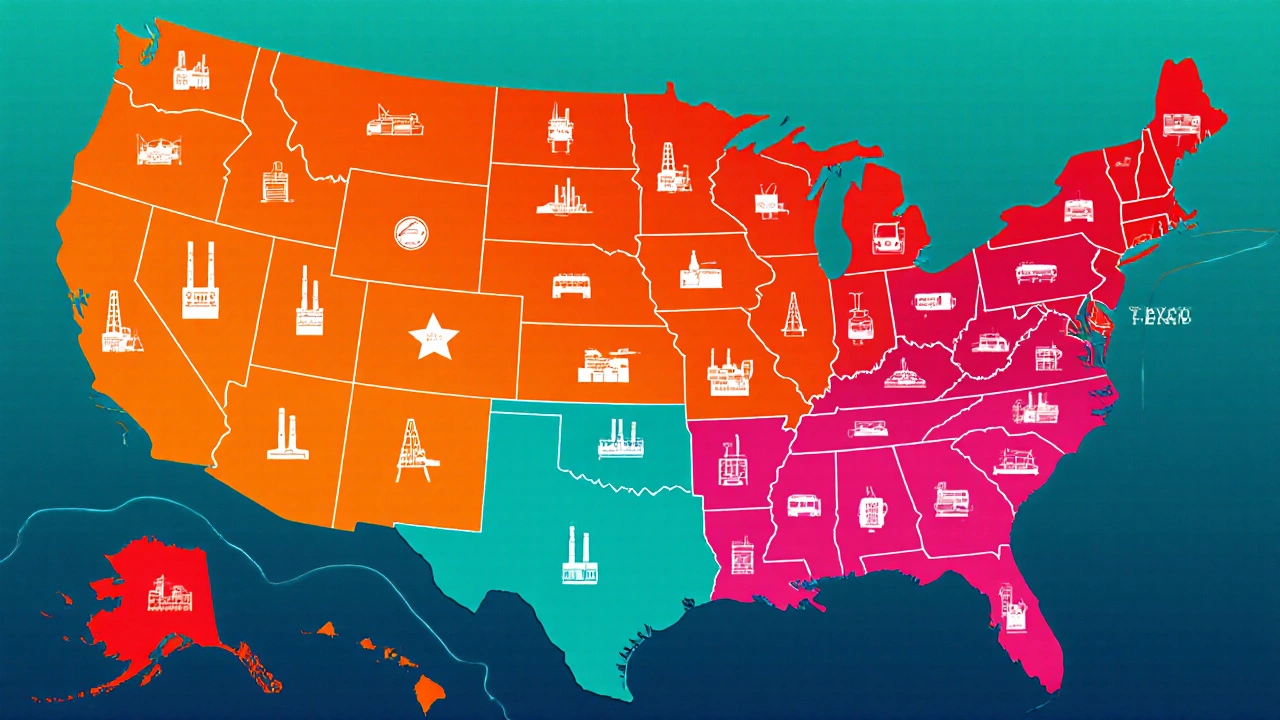

Geographic Distribution

Texas, Ohio, and Pennsylvania host ~38% of all companies.

Based on the U.S. Census Economic Census data from 2025:

- Total registered plastic-related businesses: 13,200

- NAICS codes used: 3261-3269 (covers resin, conversion, and end-product manufacturers)

- Top 10 resin producers control: ~45% of domestic resin output

- 1. Texas 3,200

- 2. Ohio 1,200

- 3. Pennsylvania 1,000

- 4. California 900

- 5. Florida 600

These five states represent 38% of all plastic companies in the U.S.

- Dow Inc. – Largest U.S. resin producer with $45B in sales

- ExxonMobil Chemical – Controls 15% of U.S. polyolefin capacity

- LyondellBasell – Speciality polymers and elastomers provider

- Amcor – Leading converter with 80 U.S. plants

- Berry Global – Major end-product manufacturer in packaging

Trends Shaping the Industry

- Consolidation: M&A activity has reduced independent resin manufacturers from 320 in 2020 to ~250 in 2025.

- Sustainability: Growing focus on recycled polymers and circular economy initiatives.

- Automation: Smart factories increasing value per firm despite lower headcount.

- Regional Incentives: Tax breaks in Texas and Ohio encouraging green resin projects.

Ever wondered just how many plastic companies in the US are churning out everything from bottle caps to automotive parts? The answer isn’t a simple number you can glance at on a billboard; it’s a mosaic of resin producers, converters, and finished‑product makers spread across fifty states. Below you’ll find a step‑by‑step breakdown, the data sources you can trust, and a quick snapshot of where the industry is headed.

Key Takeaways

- As of 2025, roughly 13,200 registered plastic‑related businesses exist in the United States.

- These firms fall into three main segments: resin manufacturers (≈ 250), converters/contract manufacturers (≈ 5,200), and end‑product manufacturers (≈ 7,750).

- The U.S. Census’ NAICS code 3261‑3269 captures >99% of the sector, making it the go‑to classification for market analysis.

- Texas, Ohio, and Pennsylvania host the highest concentration of companies, together accounting for about 38% of the total.

- Industry consolidation continues - the top 10 resin producers now control ~45% of domestic resin output.

Where the Numbers Come From

Counting plastic companies isn’t a matter of eyeballing a directory. Researchers rely on three primary data sets:

- U.S. Census Bureau - The Economic Census provides NAICS‑based counts for every manufacturing subsector. NAICS 3261 (Plastics Material Manufacturing) and 3262‑3269 (Plastics Product Manufacturing) together form the backbone of the count.

- IBISWorld - Offers annual industry reports that include the number of active firms, average revenue, and employment trends.

- Plastics Industry Association (PLASTICS) - Maintains a membership list of over 1,600 companies, which serves as a validation sample for the larger census data.

Cross‑referencing these sources yields a reliable estimate of about 13,200 plastic‑related firms as of the 2025 Economic Census release.

Breaking Down the Sector

The industry isn’t monolithic. Understanding the three layers helps you gauge market size, supply‑chain dynamics, and competitive pressure.

| Segment | Approx. Number of Companies | Typical Annual Revenue (USD) | Top States |

|---|---|---|---|

| Resin Manufacturers | ≈ 250 | $500M-$15B | Texas, Louisiana, Illinois |

| Converters / Contract Manufacturers | ≈ 5,200 | $2M-$300M | Ohio, Michigan, Pennsylvania |

| End‑Product Manufacturers | ≈ 7,750 | $1M-$2B | California, Texas, Florida |

The numbers above illustrate why converters dominate headcount - they service countless niche markets, from medical tubing to consumer electronics.

Key Players You’ll Hear About

While the long tail of small firms forms the bulk of the count, a handful of giants shape the overall landscape.

- Dow Inc. - The largest U.S. resin producer, operating 12 integrated complexes and reporting $45B in total sales.

- ExxonMobil Chemical - Holds a 15% share of U.S. polyolefin capacity.

- LyondellBasell - Provides a broad portfolio of specialty polymers and elastomers.

- Amcor - A leading converter with a footprint in packaging, operating over 200 plants worldwide, 80 of which sit in the U.S.

- Berry Global - One of the biggest end‑product manufacturers, especially in disposable packaging.

These firms account for roughly 45% of domestic resin output and a sizeable share of converter capacity, underscoring the industry’s consolidation trend.

Geographic Hotspots

Understanding where companies cluster helps you pinpoint supply‑chain advantages, labor pools, and regulatory climates.

- Texas - Home to the Gulf Coast petrochemical corridor; 3,200 plastic firms, including major resin plants.

- Ohio - The “Plastic Belt” runs through the state, offering a dense network of converters and machine builders.

- Pennsylvania - Strong in both resin production (especially PVC) and packaging converters.

- California - While less resin‑centric, it houses a vibrant ecosystem of specialty product manufacturers and biotech‑related plastics.

- Florida - Known for marine‑grade polymers and consumer‑goods converters.

These five states alone host roughly 5,000 companies, or about 38% of the national total.

Trends Shaping the Numbers

Numbers alone tell a story; the context adds depth.

- Consolidation - M&A activity has accelerated. Between 2020‑2024, the top ten resin producers acquired 14 smaller players, trimming the total count of independent resin manufacturers.

- Sustainability pressure - EPA regulations on single‑use plastics and the rise of circular‑economy initiatives are prompting new entrants focused on recycled polymer production.

- Automation - Smart factories are reducing headcount per plant, but increasing the value of each firm, especially in the converter segment.

- Regional incentives - States like Texas and Ohio offer tax breaks for “green” resin projects, spurring a modest rise in new facility permits.

All these factors mean the absolute number of firms may stay stable or even dip slightly, while total industry revenue climbs.

How to Use This Data for Market Entry

If you’re considering starting a plastic‑related business or investing in the sector, follow this quick checklist:

- Identify your niche: resin production, conversion, or end‑product manufacturing.

- Choose a location based on supply chain proximity - Texas for resin, Ohio for conversion, California for specialty products.

- Validate market size with the latest NAICS 3261‑3269 data from the U.S. Census Economic Census.

- Benchmark against the revenue ranges in the segmentation table above.

- Assess regulatory impact - check EPA’s latest rulings on single‑use plastics and state‑level recycling mandates.

- Consider partnership options with industry groups like American Chemistry Council for networking and market intelligence.

By aligning your strategy with these data points, you can avoid costly missteps and tap into the most promising growth pockets.

Frequently Asked Questions

How many plastic manufacturers are listed in the U.S. Census?

The 2025 Economic Census reports approximately 13,200 firms under NAICS codes 3261‑3269, covering resin producers, converters, and end‑product makers.

Which NAICS codes should I filter for plastic companies?

Use 3261 (Plastics Material Manufacturing) for resin producers, 3262‑3269 for various plastic product manufacturers, and 4243 for plastic material wholesalers.

What are the top three states by number of plastic firms?

Texas, Ohio, and Pennsylvania together house around 5,000 plastic companies, accounting for roughly 38% of the national total.

How has consolidation affected the number of resin manufacturers?

Mergers have reduced independent resin producers from about 320 in 2020 to around 250 in 2025, with the top ten now controlling nearly half of U.S. resin output.

Where can I find the most recent industry reports?

IBISWorld’s “Plastics Production in the US” report, the American Chemistry Council’s annual market outlook, and the U.S. Census Economic Census are the most authoritative sources.