Manufacturing Impact Calculator

Current Manufacturing Metrics

Historical Context

In 1990, U.S. manufacturing employed 20,000,000 workers and produced $1.5 trillion in output.

Today, with 40% fewer workers but 60% higher output, productivity has increased by 150%.

This shows how automation and advanced technology have transformed manufacturing while maintaining high output levels.

Productivity Analysis

Enter values above to see your calculation

When people talk about America losing its factories, they’re not wrong-but they’re also not telling the whole story. The idea that the U.S. has given up on manufacturing is a myth built on old numbers and emotional headlines. Factories haven’t vanished. They’ve changed. And the government is betting billions to bring them back-just not the way you might expect.

Manufacturing jobs dropped, but output didn’t

Since the 1970s, the U.S. has lost about 7 million manufacturing jobs. That’s real. That’s painful. But here’s what most people miss: U.S. manufacturing output is at an all-time high. In 2024, American factories produced more goods by value than ever before-over $2.5 trillion. That’s 60% higher than in 1990, even though there are 40% fewer workers.

Why? Automation. Robotics. Precision tools. A single car plant today might have 500 workers instead of 2,000, but it builds twice as many vehicles with fewer defects. Companies like Tesla, Caterpillar, and GE don’t need armies of assembly-line workers. They need engineers, technicians, and data analysts. The jobs changed. The output didn’t.

China didn’t win. The U.S. just got smarter

For years, the narrative was simple: China stole American manufacturing. But that’s not quite right. China didn’t take factories-it took low-skill, high-volume production. The U.S. moved up. Today, America leads the world in high-value manufacturing: jet engines, semiconductors, biotech equipment, and advanced medical devices. The U.S. makes 40% of the world’s high-tech machinery. It’s the top exporter of aerospace products. It still controls over 80% of the global market for semiconductor manufacturing equipment.

When Apple designs the M3 chip, it doesn’t make it in China. It designs it in California and contracts TSMC in Taiwan to build it. But the machines that build those chips? Made in Illinois. The software that runs them? Written in Texas. The raw materials? Refined in Ohio. The supply chain isn’t gone-it’s just more complex.

Government schemes are reshaping the game

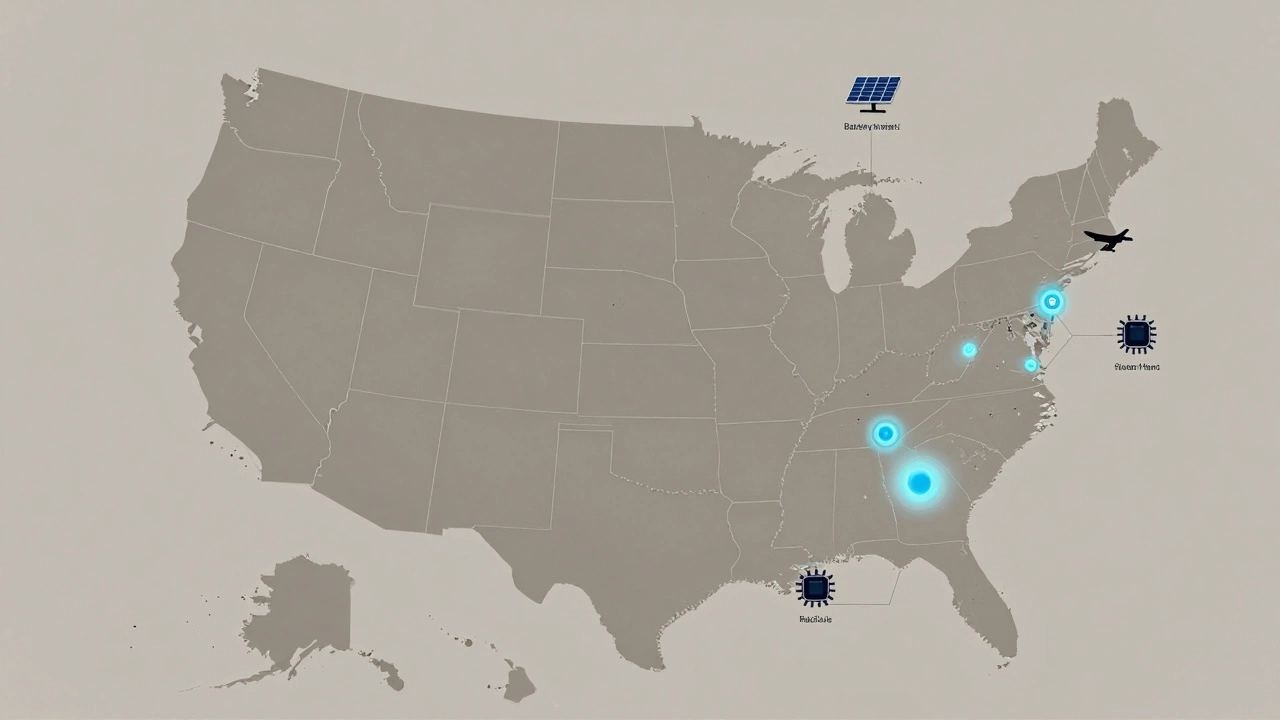

The CHIPS and Science Act of 2022 wasn’t just a bill. It was a declaration. The U.S. government committed $52 billion to bring semiconductor manufacturing home. By 2025, over $30 billion of that had already been awarded. Companies like Intel, TSMC, and Samsung are building new fabs in Arizona, Ohio, and Texas. These aren’t small projects. Intel’s new $20 billion plant in Ohio will employ 3,000 people directly and support another 10,000 in suppliers and services.

The Inflation Reduction Act didn’t stop at chips. It added $37 billion in tax credits for clean energy manufacturing-solar panels, wind turbines, batteries, and electrolyzers. By 2026, over 200 new U.S. factories will be producing components for renewable energy systems. In Georgia, a new battery plant from SK On is creating 5,000 jobs. In Michigan, Ford and Rivian are teaming up to build domestic lithium processing plants. This isn’t nostalgia. It’s strategy.

Reshoring isn’t about nostalgia-it’s about security

The pandemic showed how dangerous global supply chains can be. When masks and ventilators vanished from shelves, the U.S. realized it couldn’t rely on overseas factories for critical gear. The same happened with rare earth minerals, pharmaceuticals, and defense electronics. In 2023, the Department of Defense launched a $1.5 billion program to rebuild domestic production of 200 key materials-from tungsten to rare earth magnets.

Reshoring isn’t just about patriotism. It’s about risk. A factory in Ohio can’t be shut down by a port strike in Shanghai. A battery plant in Tennessee won’t be blocked by a trade war with Taiwan. Companies are starting to see local production as insurance, not cost-cutting.

Who’s left behind? The workers and the towns

Here’s the hard truth: not everyone benefits from this shift. The factory worker who spent 30 years on the assembly line doesn’t become a robotics technician overnight. Many rural towns that lost their auto plants or steel mills still haven’t recovered. In places like Flint, Michigan, or Youngstown, Ohio, the pain is real. The new jobs require degrees, certifications, or technical training. Not everyone has access to that.

The government is trying to fix this. The Workforce Innovation and Opportunity Act now funds local training programs tied directly to factory openings. In Pennsylvania, a community college partnered with a new battery manufacturer to create a six-month certification program. Graduates earn $25 an hour-double the local average. Similar programs are popping up in Alabama, Indiana, and North Carolina. But scaling them? That’s still a challenge.

The myth of the empty factory

Walk into a modern U.S. factory today, and you won’t see rows of workers in hard hats. You’ll see clean floors, glowing screens, and robots moving parts with millimeter precision. The machines are louder. The workers are fewer. But the output? Higher than ever.

Deindustrialization isn’t happening. Reindustrialization is. The U.S. isn’t trying to go back to 1950. It’s building something new: smarter, cleaner, and more secure. The factories are still here-they just look different.

What’s next? The next wave of manufacturing

The next big push is in advanced materials and AI-driven production. Companies are experimenting with 3D-printed metal parts for jet engines. Startups are using AI to predict machine failures before they happen. The Department of Energy just funded a $100 million project to build the first fully automated aluminum smelter in the U.S. in 40 years.

Meanwhile, the government is pushing for domestic supply chains for everything from lithium to silicon wafers. The goal? To make sure the next generation of tech-quantum computers, fusion reactors, hypersonic missiles-is made in America, not just designed here.

It’s not about jobs. It’s about capability

Deindustrialization sounds like a loss. But what’s really happening is a transformation. The U.S. stopped competing on cheap labor. Now it’s competing on innovation, speed, and reliability. The factories are still here. The workers are just better trained. The machines are smarter. And the government is finally investing like it matters.

If you think America’s manufacturing is dead, you’re looking at the wrong numbers. The real story isn’t in the job count. It’s in the output. The innovation. The new plants breaking ground every month. The U.S. didn’t lose manufacturing. It upgraded it.

Is America really losing its manufacturing base?

No. While manufacturing employment has declined since the 1970s, U.S. manufacturing output has reached record levels. Factories today produce more with fewer workers thanks to automation and advanced technology. The U.S. remains the world’s second-largest manufacturer after China, but leads in high-value sectors like aerospace, semiconductors, and medical devices.

What government programs are helping U.S. manufacturing?

The CHIPS and Science Act (2022) allocated $52 billion to rebuild semiconductor production, with over $30 billion already awarded to companies like Intel and TSMC. The Inflation Reduction Act added $37 billion in tax credits for clean energy manufacturing, including batteries and solar panels. The Department of Defense is investing $1.5 billion to secure domestic supply chains for critical materials like rare earths and tungsten. These aren’t subsidies-they’re strategic bets on national capability.

Are U.S. factories coming back from China?

Yes, but not all of them. Reshoring is happening in high-value, high-risk, or strategically important areas: semiconductors, pharmaceuticals, defense components, and clean energy tech. Low-cost, high-volume goods like clothing or toys aren’t coming back-there’s no economic reason for them to. The focus is on what the U.S. can do better, faster, or more securely than others.

Why aren’t more manufacturing jobs returning?

Modern factories don’t need the same number of workers. A single automated battery plant might employ 5,000 people, but only 1,200 are direct factory roles-the rest are engineers, software specialists, logistics coordinators, and maintenance techs. The jobs that are created require technical training, not just physical labor. Without investment in workforce development, many communities can’t fill these roles.

Is reshoring making products more expensive?

Initially, yes. Building factories and retooling supply chains costs money. But over time, it reduces risk and increases reliability. A chip made in Arizona won’t be delayed by a typhoon in Taiwan. A battery made in Michigan won’t be blocked by a trade embargo. These aren’t just costs-they’re insurance policies. And for critical industries, that reliability is worth more than a few cents saved on labor.