Indian Car Tax Calculator

Calculate Your Car's Tax Burden

Results will appear here

Compare with International Markets

Indian price vs. Indonesia/Thailand

India

Indonesia

Ever wondered why a basic hatchback in India costs nearly as much as a mid-range sedan in the US? You’re not alone. Walk into any car showroom in Delhi, Bangalore, or Chennai, and you’ll see the same thing: a Maruti Suzuki Alto priced at ₹5 lakh, while the same model in Indonesia or Thailand sells for under ₹4 lakh. Why does India charge so much more for cars that are often made right here?

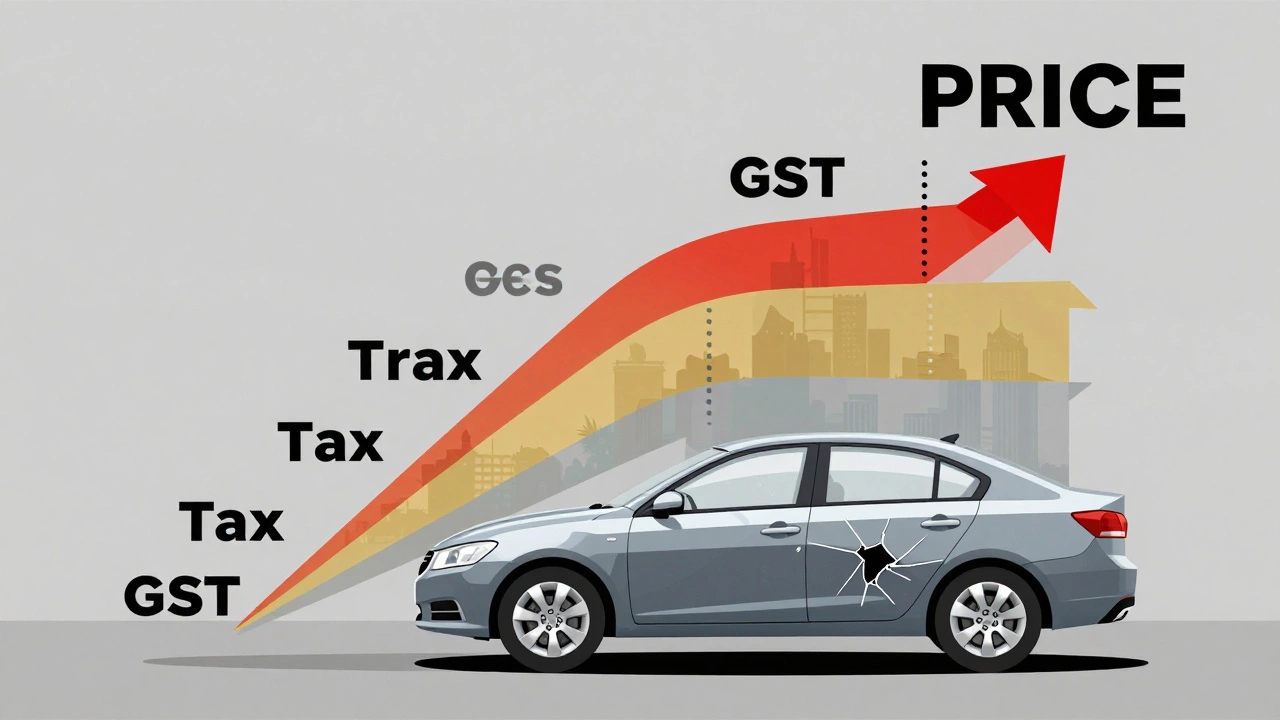

High Taxes Are the Biggest Reason

The single biggest factor pushing up car prices in India? Taxes. The government doesn’t just slap on GST - it layers multiple taxes on top of each other. A typical car in India faces:

- 18% GST on the ex-showroom price

- Additional cess of 1% to 22%, depending on engine size and type (petrol, diesel, electric)

- Compulsory insurance and registration fees

- State-level road tax, which can be 5% to 15% extra

For a car with a 1.2L petrol engine, the cess is 18%. For a 1.5L diesel SUV? That jumps to 22%. So if a car’s manufacturing cost is ₹6 lakh, taxes alone can add ₹1.8 lakh or more. That’s 30% of the final price - just from taxes. In comparison, Germany adds about 19% VAT, and the US has no national sales tax on cars - only state-level ones, usually under 10%.

Import Duties on Components

Even though most cars sold in India are made here, they still rely on imported parts. Engines, transmissions, sensors, and even basic electronics often come from Japan, Germany, or South Korea. India keeps import duties on auto components between 10% and 15%. That’s because the government wants to push local manufacturing - but it backfires. Instead of lowering prices, it raises them.

For example, a Hyundai Creta’s engine might be built in India, but its fuel injectors come from Bosch in Germany. Add 12% duty on those injectors, and that cost gets passed to you. The same part in Thailand or Vietnam faces 0-5% import tax. So even if the assembly happens in India, the parts aren’t cheap.

Low Production Volumes for Many Models

India’s car market is huge - over 5 million units sold yearly - but it’s not efficient. Most manufacturers produce only a few models in large volumes (like the Maruti Swift or Hyundai i20). But for niche cars - SUVs with advanced features, electric vehicles, or performance models - production runs are tiny.

When you make only 5,000 units of a car instead of 50,000, the per-unit cost skyrockets. Fixed costs like R&D, tooling, and quality control don’t drop just because you’re selling fewer cars. So manufacturers charge more to recover those costs. Compare that to China, where Tesla produces over 1 million Model Ys a year. That scale brings the cost down. India doesn’t have that kind of volume for most models.

Infrastructure and Logistics Costs

Getting a car from the factory to the showroom isn’t easy. India’s roads aren’t all highways. Many plants are in Tier-2 or Tier-3 cities - like Pune, Chennai, or Manesar - and getting cars to Mumbai, Delhi, or Kolkata means long hauls on congested roads. Fuel, tolls, driver wages, and vehicle wear add up.

Plus, logistics companies charge more because of delays. A truck might take 3 days to reach Bangalore from Pune instead of 1.5 days because of traffic or checkpoints. Those delays mean more storage costs, more labor hours, and higher insurance premiums. All of that gets added to the price tag.

Low Economies of Scale in the Supply Chain

Think about how many suppliers make brake pads for Indian cars. In Germany, there are maybe 20 big suppliers serving the entire auto industry. In India, there are hundreds - but most are small, under-equipped, and inefficient. They don’t buy raw materials in bulk. They don’t automate their lines. They use outdated machinery.

That means the cost of a single brake pad in India can be 20-30% higher than in Thailand or Mexico. And since Indian carmakers can’t negotiate lower prices from these small suppliers, the cost stays high. It’s a cycle: low scale → high input cost → high car price → lower sales volume → even lower scale.

Research and Development Is Expensive Here

Car companies spend a lot to make their models meet India’s unique needs. They need to adjust suspension for potholes, design engines for dusty roads, and create air filters that last longer in high-pollution zones. They also have to comply with BS6 emission norms - which cost billions to develop.

Toyota spent over ₹2,500 crore upgrading its Indian plants for BS6. That money doesn’t vanish - it gets added to the price of every car sold. In countries like Brazil or Indonesia, emission standards are less strict, so R&D costs are lower. India’s standards are among the toughest in the developing world - and that shows up in your monthly EMI.

Electric Cars Are Even More Expensive

EVs in India are priced at ₹15 lakh or more - even though the battery is the most expensive part, and India doesn’t make lithium-ion cells at scale. Almost all EV batteries are imported from China. Add 15% import duty, 18% GST, and the cess, and you’re looking at nearly 40% of the car’s price just from the battery and taxes.

Compare that to Norway, where EVs are cheaper than petrol cars because of tax breaks and subsidies. In India, EVs get a 5% GST rate - better than petrol cars - but no direct subsidies for buyers. So while the government wants you to go electric, the math still doesn’t add up for most people.

Why Don’t Local Brands Make Cheaper Cars?

You might think: Why doesn’t Tata or Mahindra make a ₹3 lakh car? Because they can’t. To build a car that cheap, you’d need:

- Massive production volume (at least 1 million units/year)

- Full vertical integration (making your own steel, batteries, electronics)

- Zero import dependency

- Government tax exemptions

No Indian company has all of that. Even Tata’s Nano - launched in 2009 at ₹1 lakh - was a loss-maker. It cost more to build than it sold for. The project was shut down after 100,000 units. The lesson? Making a cheap car isn’t just about cutting corners. It’s about building an entire ecosystem that supports ultra-low costs. India doesn’t have that ecosystem yet.

What Could Make Cars Cheaper in India?

There are real solutions - but they need political will.

- Reduce the cess on small cars - Cut the 22% cess on 1.2L engines to 5%. That alone could drop prices by ₹1.5 lakh on many models.

- Allow duty-free import of critical components - If lithium cells or advanced ECUs enter India without import tax, EV prices could drop 20% overnight.

- Consolidate the supply chain - Encourage 5-6 large auto component manufacturers instead of 500 small ones. Bulk buying = lower prices.

- One-time road tax exemption for EVs - Like in Europe, remove state road tax for electric cars for the next 5 years.

Some states like Gujarat and Tamil Nadu are already cutting registration fees to attract manufacturers. But without nationwide reform, prices won’t drop significantly.

Is It Worth It? The Bigger Picture

Yes, Indian cars are expensive. But they’re also safer, cleaner, and more reliable than they were 10 years ago. BS6 engines cut pollution by 80%. Crumple zones, airbags, and ABS are now standard - even in entry-level cars. In 2010, a ₹4 lakh car had no airbag. Today, it does.

So you’re paying more - but you’re also getting more. The question isn’t just why cars are expensive. It’s whether India is willing to pay for progress - or if it wants to stay stuck with old, unsafe, polluting cars just because they’re cheaper.

Why are Indian cars more expensive than Chinese cars?

Chinese cars are cheaper because China has massive production scale, government subsidies for EVs, zero import duties on key components, and a domestic supply chain that’s been built over 30 years. India has none of that. Indian cars face high taxes, small production runs, and costly imported parts - all of which Chinese manufacturers avoid.

Do electric cars cost less to run in India?

Yes. Even though EVs cost more upfront, they’re much cheaper to run. Charging an EV costs about ₹1 per km, while petrol cars cost ₹8-₹10 per km. Over 5 years, that’s a saving of ₹1.5-₹2 lakh. Plus, maintenance is lower - no oil changes, fewer moving parts. But the high upfront price still blocks most buyers.

Why don’t Indian carmakers just make cheaper models?

Because they can’t make a profit. The Nano proved that. To build a ₹3 lakh car, you need to sell over a million units a year, control your supply chain, and get tax breaks. No Indian company has that scale or support. Cutting corners on safety or quality isn’t an option - it’s illegal and risky.

Are imported cars more expensive than made-in-India cars?

Usually yes. Imported cars face 100%+ customs duty if they’re fully built units (CBUs). Even if they’re assembled locally (CKD), they still pay 15-20% on imported parts. So a BMW X1 made in India still costs more than a Maruti Suzuki because of brand premium and higher taxes on luxury features.

Will car prices drop in India by 2030?

Only if the government acts. If import duties on batteries and electronics are removed, if GST cess is capped at 5% for small cars, and if supply chains are consolidated, prices could drop 25-30%. Without policy change, prices will keep rising with inflation and fuel costs.